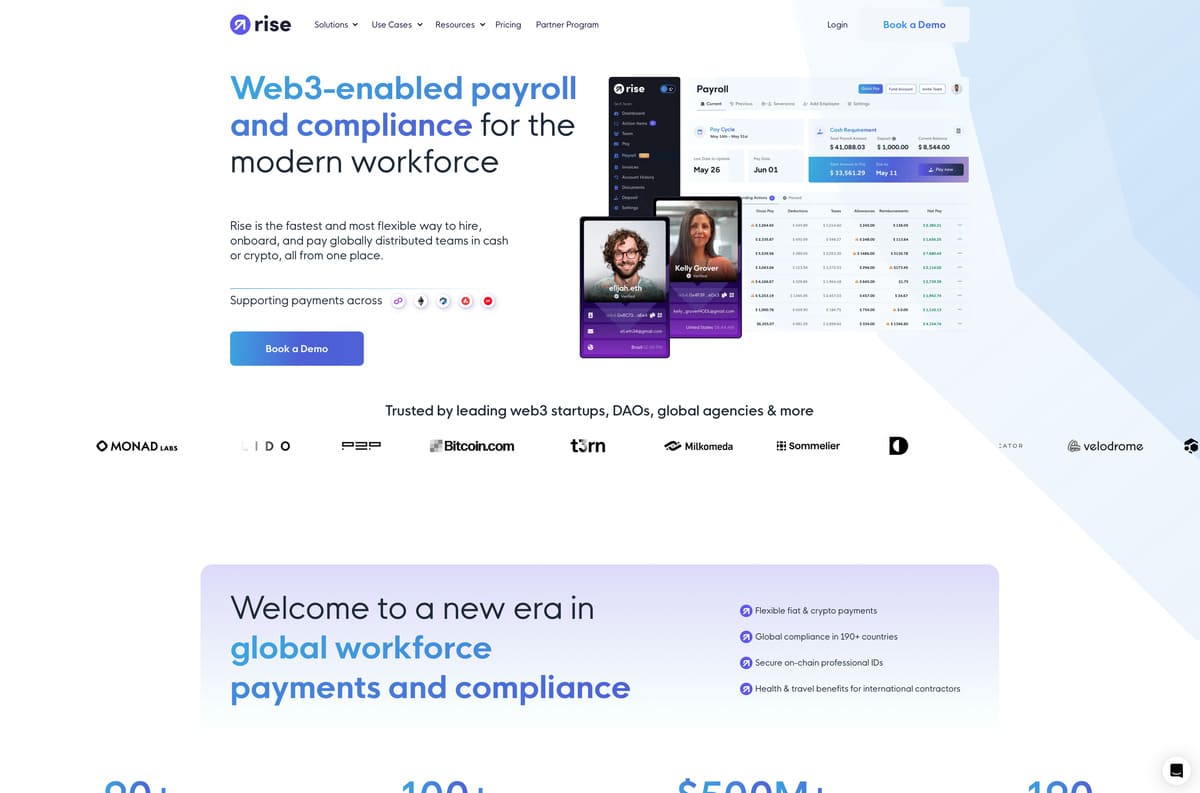

Rise is a comprehensive platform that streamlines the hiring, onboarding, and payment processes for globally distributed teams, offering flexibility in both fiat and cryptocurrency transactions. Read on for our full review of Rise.

Key services offered by Rise

- Hybrid payroll solutions: Rise facilitates payments in over 90 local currencies and more than 100 cryptocurrencies, including stablecoins like USDC, USDT, and DAI, catering to diverse workforce preferences.

- Employer of Record (EOR) services: Acting as the legal employer, Rise manages compliance, payroll, taxes, and benefits, enabling businesses to hire globally without establishing local entities.

- Automated onboarding and compliance: The platform ensures efficient onboarding with Know Your Customer (KYC) checks and generates compliant professional agreements, simplifying global contractor management.

- Flexible payment schedules: Rise supports various payment structures, including milestones, recurring, hourly, instant, or one-off payments, accommodating the diverse needs of a global workforce.

- International health and travel benefits: Through a global partner network, Rise offers health and travel insurance benefits to international contractors, enhancing their overall employment package.

Company profile

Rise is a registered Money Services Business with FinCEN in the United States, ensuring compliance with financial regulations. The platform is built on Ethereum and Arbitrum, reflecting its commitment to leveraging blockchain technology for secure and efficient operations.

Trusted by leading web3 startups, Decentralised Autonomous Organisations (DAOs), and global agencies, Rise has facilitated over $300 million in payments across 190 countries. The company’s dedication to innovation and customer-centric solutions was recognised when it secured first place at Coindesk’s Pitch Fest at Consensus 2023.

In 2023, Rise expanded its payout options to include instant direct deposits in multiple currencies, such as USD, GBP, and EUR, with plans to add more currencies, including CAD, BRL, and MXN, to support a broader range of countries.

By integrating fiat and crypto payments with global workforce management, Rise simplifies operations and enhances productivity for businesses operating in the modern, decentralised economy.

Pros and cons

Pros

- Comprehensive global payroll: Rise supports payments in over 90 fiat currencies and more than 100 cryptocurrencies, including stablecoins, catering to diverse workforce preferences.

- Flexible payment structures: Businesses can choose from milestone, hourly, recurring, or one-off payments, providing adaptability for various compensation models.

- Seamless compliance management: Employer of Record (EOR) services handle complex legal requirements, such as tax compliance and benefits, enabling effortless global hiring.

- Automated onboarding: Streamlined onboarding with KYC checks and pre-generated compliant contracts simplifies managing international contractors.

- Integrated benefits: Access to global health and travel insurance enhances employee satisfaction and retention.

- Cutting-edge technology: Built on Ethereum and Arbitrum, Rise leverages blockchain for secure and efficient operations.

- Customisation: Rise offers tailored solutions to meet the unique needs of businesses across industries and sizes.

Cons

- Crypto reliance may not suit all businesses: While offering extensive cryptocurrency payment options, businesses less familiar with crypto may face a learning curve.

- Cost transparency for smaller teams: While pricing is scalable, smaller businesses may find upfront cost breakdowns less detailed compared to some competitors.

- Limited information on advanced features: Some advanced features, such as integrations with third-party platforms, may require direct consultation with the sales team for clarity.

- Dependence on blockchain infrastructure: Although robust, reliance on blockchain networks may result in occasional delays or higher fees during network congestion.

- Niche appeal: Rise’s focus on web3 startups and DAOs may limit its appeal for businesses in more traditional industries.

FAQ

Rise is ideal for businesses managing globally distributed teams, including web3 startups, DAOs, agencies, and companies expanding internationally. It’s particularly useful for those seeking to streamline payroll, compliance, and payments across multiple currencies and regions.

Yes, Rise supports payments in fiat currencies, offering businesses the flexibility to pay contractors and employees in their preferred local currency alongside cryptocurrency options.

Rise handles compliance by acting as the legal employer for EOR services, adhering to local labour laws, tax regulations, and employee benefit requirements. This allows businesses to focus on operations without worrying about complex legal obligations.

Yes, Rise accommodates one-off payments in addition to recurring, milestone-based, or hourly payment schedules, offering flexibility in managing contractor or employee compensation.

Rise automates the onboarding process, including generating compliant contracts and conducting KYC checks. This simplifies bringing new contractors or employees into a business, regardless of their location.

Businesses can get started by creating an account, providing team details, and specifying payment preferences. Rise’s support team is available to assist with setting up and customising the platform for specific needs.

While fees for instant payouts may apply, they are designed to remain competitive. Businesses can access faster payment options in multiple currencies, including USD, GBP, and EUR, with minimal transaction delays.