As businesses globalize, the complexity of managing payroll across multiple countries grows. Understanding the costs and logistics of paying international employees is crucial for companies hiring abroad. Here, we delve into the common methods—setting up a local entity and using an international Professional Employer Organization (PEO) or Employer of Record (EOR)—and outline their costs, pros, and cons. So, how much does international payroll cost?

International payroll prices and fees

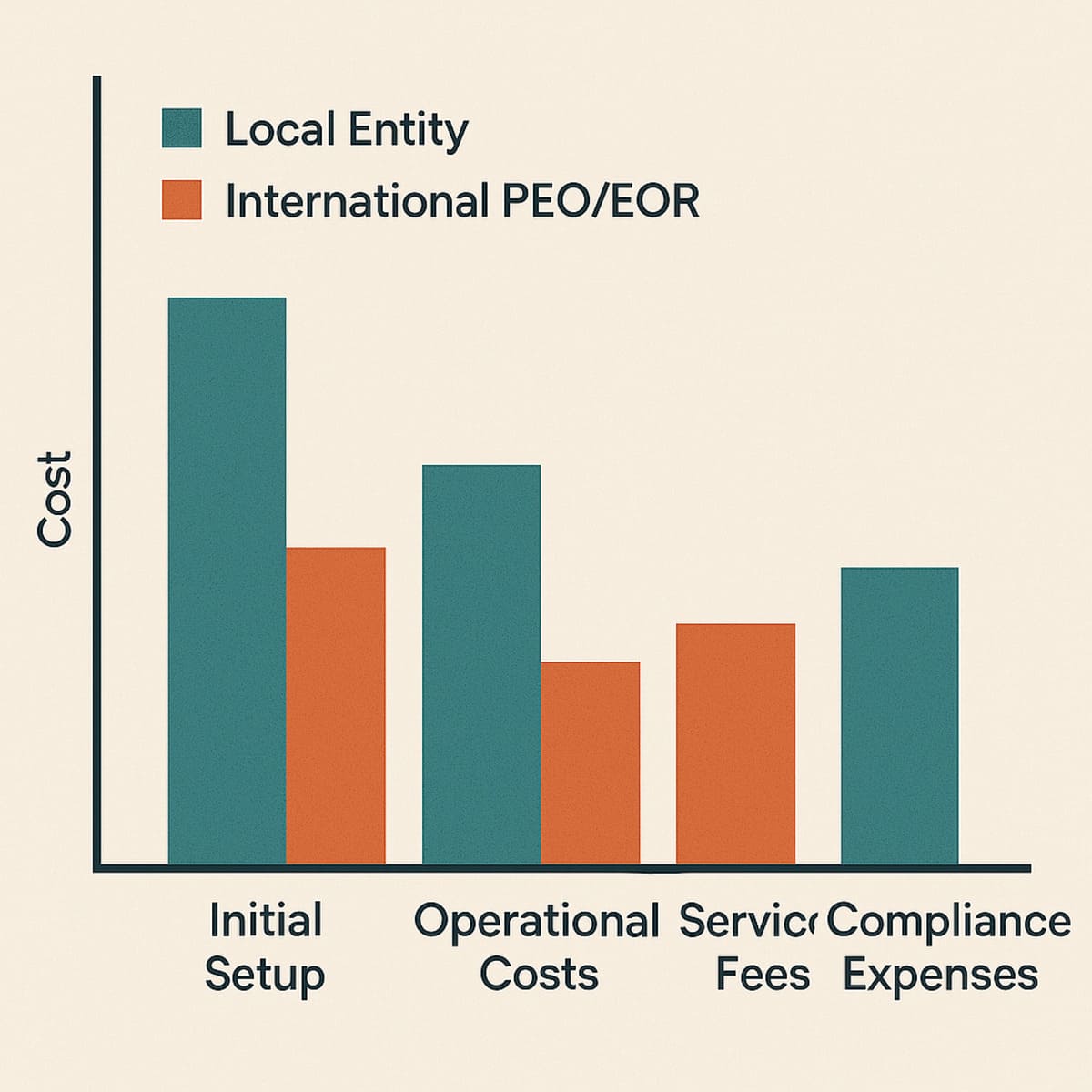

Here’s a pricing data table that compares the costs associated with setting up a local entity versus using an international PEO/EOR for payroll purposes. This table includes typical fees like setup costs, operational expenses, and service fees that businesses might incur when paying global employees.

| Cost Category | Cost of setting Up a Local Entity | Cost of using International PEO/EOR |

|---|---|---|

| Initial Setup Fees | $5,000 to $100,000 | $500 to $5,000 |

| Operational Costs | Varies widely depending on local salaries, taxes, and benefits; can be substantial | Included in service fees; additional charges may apply for custom HR services |

| Service Fees | Not applicable | 10% to 20% of employee’s salary |

| Compliance and Legal Fees | Varies; can be significant due to different regulations in each country | Typically included; additional legal support may incur more costs |

| Capital Requirements | May require significant capital depending on the country’s business regulations | Not applicable |

| Tax Implications | Dependent on local tax laws; requires careful planning to optimize | Managed by the PEO/EOR, but specific tax advantages or obligations depend on the local laws |

Key pricing insights:

- Setting up a local entity involves high initial investment and ongoing operational costs but offers complete control and a strong market presence.

- Using an international PEO/EOR reduces upfront costs and simplifies compliance but at the expense of direct control over employees and dependency on another service provider for critical HR functions.

This table is a generalized overview, and actual costs can vary significantly based on the specific country and the scale of operations. It’s advisable to consult with financial and legal experts in the target country to get detailed and accurate cost assessments tailored to your specific situation.

International payroll costs by country

Estimating international payroll costs involves considering various factors, including gross salaries, employer social security contributions, payroll taxes, and other mandatory expenses.

These costs can vary significantly across countries due to differing tax rates, social security systems, and employment laws. Below is a comparative overview of average employer payroll costs as a percentage of gross salary for selected countries:

| Country | Employer Payroll Costs (% of Gross Salary) | Notes |

|---|---|---|

| Belgium | 25% – 30% | High employer social security contributions. |

| France | 35% – 45% | Significant social security and other employer contributions. |

| Germany | 20% – 25% | Includes health, pension, and unemployment insurance contributions. |

| Italy | 30% – 35% | Comprises social security and other mandatory contributions. |

| Netherlands | 25% – 30% | Covers social security and employee insurance schemes. |

| Spain | 30% – 35% | Includes social security contributions for various benefits. |

| United Kingdom | 13.8% | Employer National Insurance contributions. |

| United States | 7.65% | Covers Social Security and Medicare taxes. |

| Canada | 10% – 12% | Includes contributions to Canada Pension Plan and Employment Insurance. |

| Australia | 9.5% – 10% | Superannuation contributions mandated by law. |

| Japan | 15% – 20% | Comprises health insurance, pension, and other contributions. |

| China | 30% – 40% | Varies by city; includes pension, health insurance, and housing fund contributions. |

| Brazil | 70% – 80% | High due to numerous social contributions and labour obligations. |

| India | 20% – 25% | Includes provident fund, gratuity, and other statutory benefits. |

| Russia | 30% | Standard rate for social contributions. |

| South Africa | 2% – 5% | Includes contributions to unemployment insurance and skills development. |

| Mexico | 30% – 35% | Covers social security, housing fund, and other contributions. |

| Argentina | 25% – 30% | Includes pension, health insurance, and other contributions. |

| South Korea | 10% – 15% | Comprises national pension, health insurance, and employment insurance. |

| Saudi Arabia | 10% – 12% | Includes contributions to social insurance. |

| United Arab Emirates | 12.5% – 15% | Applicable to UAE nationals; includes pension and other benefits. |

| Singapore | 17% | Central Provident Fund contributions. |

| Malaysia | 12% – 13% | Employees Provident Fund contributions. |

| Indonesia | 10% – 12% | Includes pension, health insurance, and other contributions. |

| Thailand | 5% – 6% | Comprises social security and health insurance contributions. |

| Philippines | 10% – 12% | Includes social security, health insurance, and housing fund contributions. |

| Vietnam | 21.5% | Covers social insurance, health insurance, and unemployment insurance. |

| Turkey | 20.5% | Standard rate for social security contributions. |

| Egypt | 25% – 30% | Includes social insurance contributions. |

| Nigeria | 10% – 12% | Comprises pension and other statutory contributions. |

Please note that these percentages are approximate and can vary based on specific circumstances, such as industry, employee income levels, and regional regulations within each country.

Additionally, some countries may have other mandatory costs, such as 13th-month salaries or bonuses, which can further impact total payroll expenses.

Cost of setting up a local entity to run payroll

Establishing a local entity means setting up a subsidiary or branch office in the foreign country where the employees are located. This involves registering the business according to local laws, which allows the company to run payroll under the country’s regulations.

Pros:

- Full control: Having a local entity gives your business direct oversight of its operations and payroll processes.

- Market presence: Establishing a physical presence can enhance your brand’s reputation within the market.

Cons:

- High costs: The initial setup costs can be significant, including legal fees, registration costs, and capital requirements.

- Complex compliance: Each country has its own legal and tax intricacies, requiring local knowledge to ensure compliance.

Cost Breakdown:

- Setup fees: Can range from $5,000 to $100,000 or more, depending on the country and the complexity of the business structure.

- Operational costs: Ongoing expenses such as salaries, benefits, taxes, and administrative costs. Compliance and legal advisory fees can also add up.

- Tax implications: Vary significantly across different jurisdictions and can affect the overall financial efficiency of the entity.

Cost of international PEO / EOR

An International PEO/EOR acts as the legal employer of your staff in the host country and manages payroll, tax, and HR responsibilities. This model does not require businesses to set up a local entity.

Pros:

- Speed: Much faster to set up compared to establishing a local entity.

- Reduced liability: The PEO/EOR assumes much of the legal and compliance risks.

- Flexibility: Easier to scale up or down without the commitments of a local entity.

Cons:

- Less control: Your business will have less direct control over the employees as they are technically employed by the PEO/EOR.

- Dependence: Reliance on the PEO/EOR for handling sensitive aspects of employment like payroll and compliance.

Cost Breakdown:

- Service fees: Typically charged as a percentage of the employee’s salary, usually ranging from 10% to 20%.

- Setup fees: Some PEO/EOR services may charge an initial setup fee, which can vary from a few hundred to several thousand dollars.

- Miscellaneous costs: Potential additional costs for customised HR services or added legal support.

Compliance considerations for paying international employees

When expanding payroll operations internationally, compliance with local labour and tax laws is paramount. This involves a complex array of considerations that can significantly impact the costs and feasibility of various payroll strategies.

Local Employment Laws: Each country has its own set of employment laws, which can dictate everything from minimum wage to termination protocols. Non-compliance can result in heavy fines and legal disputes. For example, in France, employers must adhere to strict working hour regulations and provide ample vacation time, while in Japan, employee consent is needed for any reduction in pay.

Tax Regulations: Tax compliance is another critical area, with each country offering a unique landscape of income tax, social security contributions, and benefits taxation. Failure to accurately withhold and remit these taxes can lead to penalties. In the US, for instance, employers must comply with federal, state, and sometimes local tax regulations, which vary widely. In contrast, countries like the UAE have no personal income tax but enforce stringent penalties for non-compliance with payroll submissions.

Data Protection Laws: With the rise of GDPR in Europe and similar laws elsewhere, protecting employee data has become a crucial aspect of payroll compliance. Businesses must ensure that their payroll systems and processes safeguard employee data and comply with cross-border data transfer rules. Non-compliance can lead to sanctions, which might include fines of up to 4% of global annual turnover under GDPR.

Permanent Establishment Risk: Operating payroll in a foreign country can lead to a permanent establishment (PE) status, creating a taxable presence in that country which significantly alters tax obligations. Understanding and planning for PE risks is essential to avoid unexpected tax liabilities.

Cultural Considerations: Beyond the hard laws, understanding and integrating into the local business culture can help mitigate compliance risks. Practices acceptable in one country might be frowned upon or even illegal in another, affecting employee relations and public perception.

Employing a local legal advisor or partnering with an experienced international PEO/EOR can help navigate these complexities. This approach ensures compliance and can prevent costly legal and financial penalties while smoothing the pathway for successful international business operations.

Comparison and recommendation

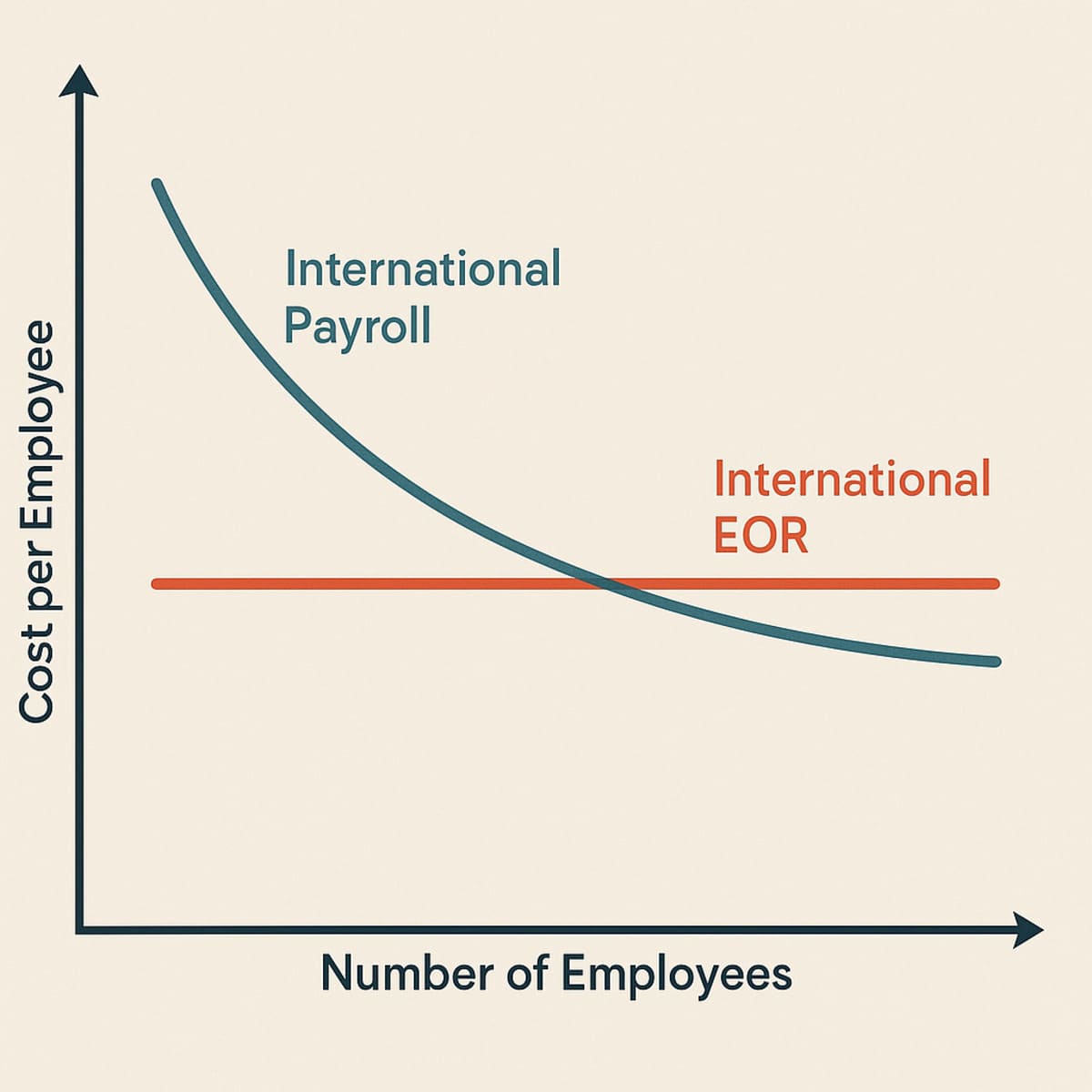

When to choose a local entity:

- Your business requires a long-term, substantial presence in the foreign market.

- You are prepared to invest significantly in the local market and can manage complex legal and tax structures.

When to use an International PEO/EOR:

- Your business needs to quickly enter a new market without significant upfront investment.

- You prefer to test the market before making a substantial commitment.

Final thoughts

The choice between establishing a local entity and employing through an international PEO/EOR largely depends on your business’s strategy, budget, and risk tolerance.

Both options come with distinct advantages and challenges, making it essential to thoroughly evaluate your long-term business goals and the specific conditions of the host country.

Consulting with international payroll and legal experts can provide tailored insights and help in making an informed decision that aligns with your business objectives.

FAQ – International payroll costs

Setup fees range from $5,000 to $100,000, influenced by the country and business complexity.

PEO/EOR services generally charge 10% to 20% of the employee’s salary as a service fee.

Operational costs vary, including local salaries, taxes, and benefits. Compliance and legal advisory fees can also be substantial.

Initial setup fees for PEO/EOR services can range from $500 to $5,000, depending on the services required.

Tax implications vary by country but can significantly impact overall payroll costs, requiring strategic financial planning to optimize.

Yes, compliance and legal fees are typically included in PEO/EOR service fees, though complex legal support may incur additional charges.

Capital requirements vary widely, often several thousand to over $100,000, depending on local business regulations.

While not hidden, additional costs may include custom HR services and specialized legal support, which are not always covered in the standard fees.

Currency fluctuations can significantly affect payroll costs, potentially increasing expenses by 5% to 25%, depending on the exchange rate movements.

Regulatory changes can increase compliance costs by up to 20%, necessitating updates in payroll systems and processes.

Long-term contracts with PEO/EOR services can reduce service fees by 5% to 15%, thanks to volume discounts and negotiated rates.